Optimize Your Home Financing Possible with a Mortgage Broker Glendale CA

Optimize Your Home Financing Possible with a Mortgage Broker Glendale CA

Blog Article

The Advantages of Engaging a Home Loan Broker for First-Time Homebuyers Looking For Tailored Funding Solutions and Specialist Assistance

For newbie buyers, browsing the complexities of the home loan landscape can be overwhelming, which is where engaging a home loan broker verifies vital. Brokers provide customized financing solutions tailored to specific monetary situations, while additionally supplying experienced assistance throughout the whole process.

Understanding Home Mortgage Brokers

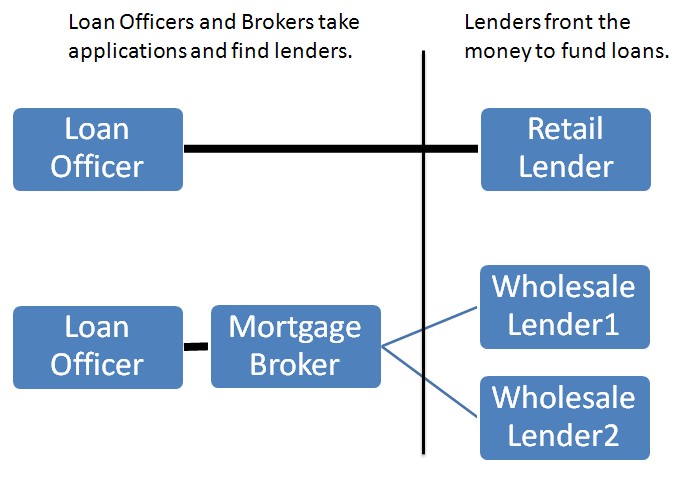

A home mortgage broker functions as an intermediary between lending institutions and customers, helping with the financing application procedure for buyers. They have expertise in the home mortgage market and are skilled in different borrowing products available. This knowledge permits them to lead newbie buyers through the typically complex landscape of home loan choices.

Commonly, mortgage brokers deal with a series of lenders, allowing them to present several financing options tailored to the certain requirements of their clients. Their duty includes examining a borrower's financial scenario, credit reliability, and homeownership goals to match them with suitable lenders. This not just saves time yet also improves the chance of protecting favorable funding terms.

Additionally, home mortgage brokers take care of the documents and connect with lenders in support of the debtor, enhancing the process and easing some of the tension connected with getting a mortgage. They also remain updated on sector trends and regulatory adjustments, making sure that clients receive timely and exact suggestions. By leveraging their partnerships with lending institutions, home mortgage brokers can frequently work out far better prices and terms than individuals could safeguard by themselves, making their services indispensable for newbie buyers navigating the mortgage process.

Personalized Financing Solutions

Personalized funding solutions are vital for newbie property buyers seeking to navigate the complexities of the home loan landscape. Each buyer's financial situation is distinct, incorporating differing credit rating, earnings levels, and individual economic objectives. Engaging a home mortgage broker allows purchasers to accessibility tailored funding options that straighten with their particular requirements, making certain an extra reliable home loan experience.

Mortgage brokers have access to a vast variety of lending institutions and home mortgage products, which allows them to existing customized options that might not be readily available through conventional banks. They can evaluate a customer's monetary profile and recommend appropriate finance programs, such as conventional car loans, FHA finances, or VA lendings, relying on the person's goals and qualifications.

Moreover, brokers can bargain terms with lenders in behalf of the homebuyer, potentially securing far better rates of interest and reduced fees. This customized method not just improves the opportunities of finance authorization but likewise provides tranquility of mind, as new buyers commonly really feel overwhelmed by the decision-making process.

Inevitably, personalized financing solutions offered by mortgage brokers equip newbie property buyers to make enlightened choices, leading the way toward effective homeownership customized to their financial circumstances. Mortgage Broker Glendale CA.

Specialist Support Throughout the Process

Specialist support throughout the home loan procedure is invaluable for first-time buyers, that might locate the complexities of protecting a funding discouraging. A home mortgage broker acts as an essential source, using knowledge that assists navigate the myriad of choices and needs entailed. From the first examination to closing, brokers offer quality on each action, making sure that property buyers recognize their choices and effects.

Home mortgage brokers simplify the application procedure by helping with paperwork and documents, which can commonly be overwhelming for newbies. They help recognize possible risks, educating clients on usual blunders to stay clear of, and making sure that all needed info is properly provided to lending institutions. This proactive method not only streamlines the process however also boosts the probability of protecting desirable funding terms.

Accessibility to Numerous Lenders

Accessibility to multiple lenders is a substantial advantage for first-time property buyers collaborating with a home loan broker. Unlike standard financial institutions, which may use a restricted array of home mortgage items, a mortgage broker has access to a diverse network of lenders, consisting of regional banks, lending institution, and national institutions. This broad access enables brokers to provide a selection of funding alternatives tailored to the Continue unique financial situations and preferences of their customers.

By reviewing multiple loan providers concurrently, homebuyers can profit from affordable rate of interest and differed loan terms (Mortgage Broker Glendale CA). This not only increases the possibility of safeguarding a mortgage that fits their budget yet additionally offers the opportunity to contrast different items, making sure educated decision-making. In addition, a home mortgage broker can identify particular niche lenders that might offer specific programs for first-time customers, such as reduced down settlement options or grants

Furthermore, having access to numerous loan providers boosts settlement power. Brokers can take advantage of deals and terms from one loan provider against another, potentially causing better financing plans. This degree of access ultimately empowers newbie property buyers, providing them with the devices necessary to browse the intricacies of the home mortgage market with confidence.

Time and Expense Efficiency

Dealing with a home loan broker not just gives access to several lenders but additionally substantially improves time and cost efficiency for first-time property buyers (Mortgage Broker Glendale CA). Navigating the complex landscape of home loan options can be intimidating; nonetheless, brokers simplify this procedure by leveraging their industry proficiency and well-known relationships with loan providers. This allows them to promptly determine suitable financing products tailored to the purchaser's monetary situation and objectives

Additionally, mortgage brokers conserve clients important time by dealing with the tiresome documents and communication included in the home mortgage application process. They make sure that all paperwork is full and accurate prior to submission, reducing the probability of hold-ups triggered by missing out on information. This aggressive method quickens authorization timelines, enabling purchasers to protect financing more swiftly than if they were to browse the procedure individually.

Final Thought

Involving a home loan broker gives first-time property buyers with vital advantages in navigating the facility landscape of home funding. By streamlining the home mortgage process and leveraging partnerships with multiple lending institutions, brokers enhance both performance and cost-effectiveness.

For new property buyers, browsing the intricacies of the mortgage landscape can be difficult, which is where engaging a mortgage broker verifies indispensable.In addition, home loan brokers handle the documents and connect with lenders on behalf of the borrower, streamlining the procedure and reducing some of the stress connected with getting a mortgage. By leveraging their relationships with lenders, mortgage brokers can frequently bargain much better rates and terms than people could secure on their hop over to here own, making their solutions indispensable for novice property buyers browsing the mortgage process.

Eventually, engaging a home loan broker makes certain that buyers get tailored assistance, aiding to debunk the home mortgage process and lead them toward successful homeownership.

Unlike traditional banks, which may supply a restricted variety of home loan products, a home mortgage broker has accessibility to a varied network of loan providers, consisting of neighborhood financial institutions, credit scores unions, and see it here nationwide establishments.

Report this page